Facts About Pacific Prime Revealed

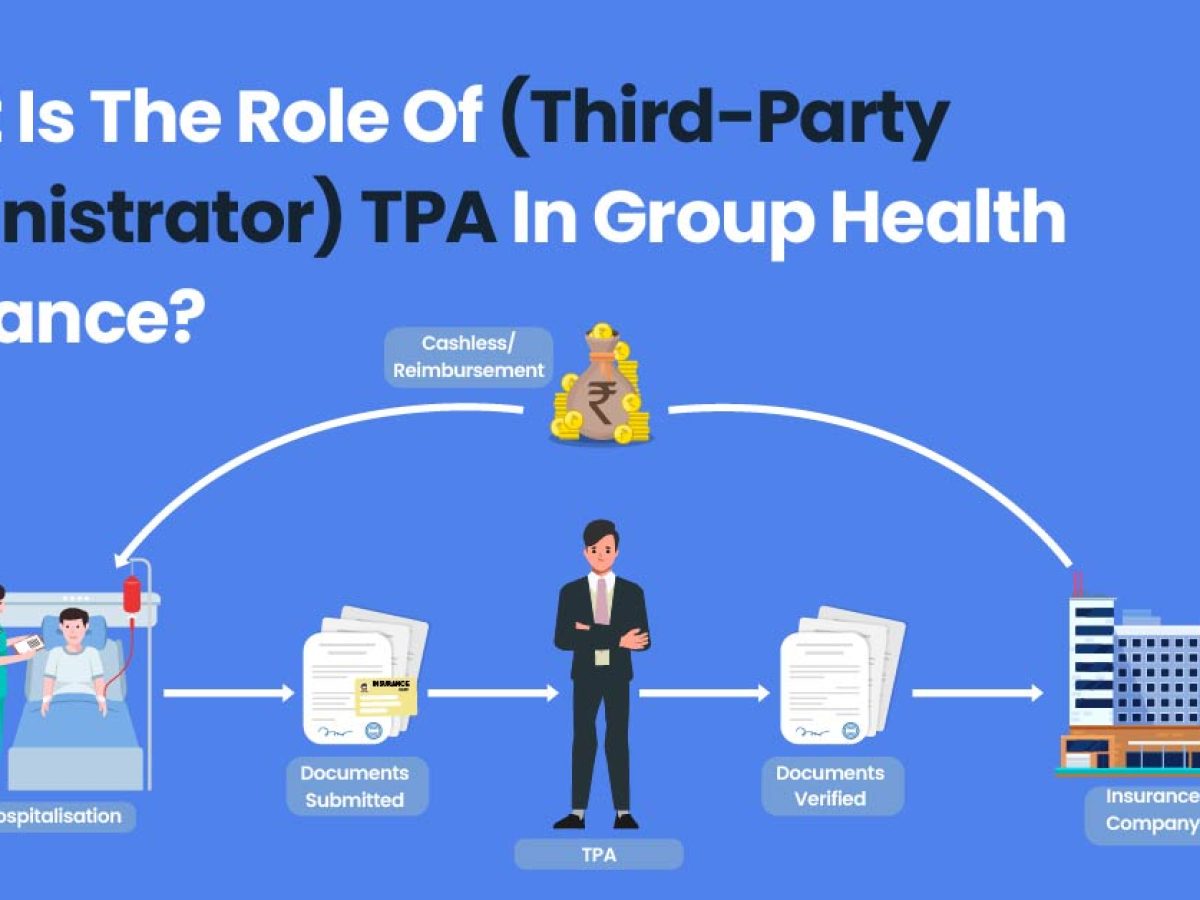

Insurance policy also assists cover expenses connected with responsibility (lawful duty) for damages or injury triggered to a third party. Insurance policy is a contract (plan) in which an insurance company compensates an additional against losses from certain backups or perils.

Investopedia/ Daniel Fishel Many insurance plan kinds are offered, and practically any private or organization can locate an insurer happy to guarantee themfor a rate. Common individual insurance coverage plan types are auto, wellness, homeowners, and life insurance policy. Most people in the USA contend the very least among these kinds of insurance coverage, and cars and truck insurance is needed by state law.

The Basic Principles Of Pacific Prime

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Locating the price that is right for you requires some legwork. The policy limit is the optimum amount an insurance provider will pay for a covered loss under a policy. Maximums might be established per duration (e.g., annual or plan term), per loss or injury, or over the life of the plan, additionally known as the lifetime maximum.

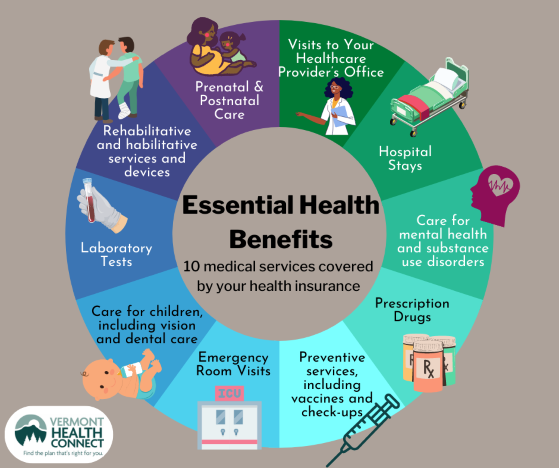

Plans with high deductibles are generally less costly since the high out-of-pocket expenditure typically causes less tiny claims. There are several various kinds of insurance coverage. Allow's look at one of the most essential. Wellness insurance policy helps covers routine and emergency treatment costs, frequently with the alternative to add vision and oral solutions separately.

Lots of precautionary solutions might be covered for cost-free prior to these are satisfied. Health and wellness insurance policy might be purchased from an insurance policy business, an insurance coverage agent, the federal Wellness Insurance coverage Industry, supplied by an employer, or government Medicare and Medicaid coverage.

Getting My Pacific Prime To Work

The company then pays all or most of the protected prices connected with a vehicle mishap or various other lorry damage. If you have a leased lorry or obtained cash to acquire an automobile, your lending institution or leasing dealership will likely need you to carry auto insurance policy.

A life insurance policy plan warranties that the insurance company pays a sum of money to your recipients (such as a spouse or children) if you die. In exchange, you pay costs throughout your lifetime. There are two main kinds of life insurance policy. Term life insurance coverage covers you for a specific duration, such as 10 to 20 years.

Long-term life insurance policy covers your whole life as long as you proceed paying the costs. Travel insurance policy covers the costs and losses connected with traveling, including trip cancellations or delays, insurance coverage for emergency situation healthcare, injuries and emptyings, harmed luggage, rental vehicles, and rental homes. Also some of the ideal travel insurance coverage firms do not cover terminations or hold-ups as a this content result of weather, terrorism, or a pandemic. Insurance is a way to manage your financial risks. When you buy insurance, you acquire defense against unanticipated financial losses.

The 3-Minute Rule for Pacific Prime

There are numerous insurance coverage policy types, some of the most typical are life, wellness, property owners, and automobile. The right sort of insurance for you will depend upon your objectives and economic scenario.

Have you ever had a moment while looking at your insurance coverage policy or purchasing for insurance policy when you've assumed, "What is insurance? Insurance policy can be a mystical and confusing thing. How does insurance policy work?

Enduring a loss without insurance policy can place you in a hard financial circumstance. Insurance is a vital monetary device.

The 4-Minute Rule for Pacific Prime

And in many cases, like automobile insurance and employees' payment, you might be required by regulation to have insurance in order to secure others - maternity insurance for expats. Discover ourInsurance alternatives Insurance is essentially a big stormy day fund shared by many individuals (called insurance policy holders) and taken care of by an insurance policy carrier. The insurance policy business utilizes cash collected (called costs) from its insurance policy holders and various other investments to spend for its operations and to satisfy its guarantee to insurance holders when they sue